Get Help to Avoid Foreclosure

Stop foreclosure and save your credit.

Setting Goals to Resolve Foreclosure: A Path to Reclaiming Financial Stability

In the face of foreclosure, establishing clear goals is crucial for those seeking to overcome this challenging situation and regain control of their financial future. By proactively setting objectives, individuals can develop a roadmap that leads them out of foreclosure and towards a brighter tomorrow.

STEP 1. Assess the current financial situation:

By thoroughly analyzing income, expenses, and outstanding debts, individuals can gain a comprehensive understanding of their financial landscape. This assessment serves as a foundation for setting realistic goals tailored to their specific circumstances.

STEP 2. Setting specific, measurable, attainable, relevant, and time-bound (SMART) goals is essential.

For instance, one might aim to negotiate with the lender to modify the mortgage terms, pursue refinancing options, or explore the possibility of selling the property to avoid foreclosure. Each of these goals should be broken down into actionable steps, making the overall process more manageable.

STEP 3. Seeking professional advice is highly recommended during this process.

Engaging with foreclosure prevention counselors, financial advisors, or legal experts who specialize in foreclosure can provide valuable guidance. These professionals can help explore available options, negotiate with lenders, review legal documents, and ensure compliance with local regulations.

STEP 4. It’s crucial to maintain open lines of communication with the lender throughout the foreclosure resolution process.

By proactively engaging in dialogue and keeping them informed about the progress made towards meeting the set goals, individuals demonstrate their commitment to resolving the situation and their willingness to find a mutually beneficial solution.

STEP 5. Taking proactive steps to increase income or reduce expenses can also significantly contribute to resolving foreclosure.

Exploring additional employment opportunities, downsizing certain expenses, or seeking government assistance programs are viable options worth considering. Building an emergency fund to address unforeseen circumstances can provide a safety net and aid in navigating the challenges of foreclosure.

STEP 6. Lastly, perseverance is key.

Resolving foreclosure can be a complex and time-consuming process, but by staying focused on the goals and being resilient in the face of setbacks, individuals can steadily progress towards a positive outcome. It’s important to remember that the path to resolution may require patience, creativity, and adaptability.

Setting goals to resolve foreclosure is a powerful way to reclaim financial stability and rebuild a secure future. By assessing the situation, setting SMART goals, seeking professional guidance, maintaining communication with the lender, taking proactive measures to improve finances, and staying resilient, individuals can navigate the foreclosure process successfully, paving the way for a fresh start and brighter financial horizons.

Consider Your Situation

Your options to resolve a foreclosure can be affected by a variety of factors, including your loan type, the stage of foreclosure, your goals, options you’ve already tried, and any limitations or challenges you may be facing. Here are some ways in which these factors can impact your options:

- Loan type:

- Different loan types may have different options available for avoiding foreclosure. For example, FHA loans may offer more flexible repayment plans or loan modifications, while VA loans may have options for veterans who are struggling to make their mortgage payments. Private loans may have fewer options available, but it’s still worth exploring potential alternatives with your lender or an attorney.

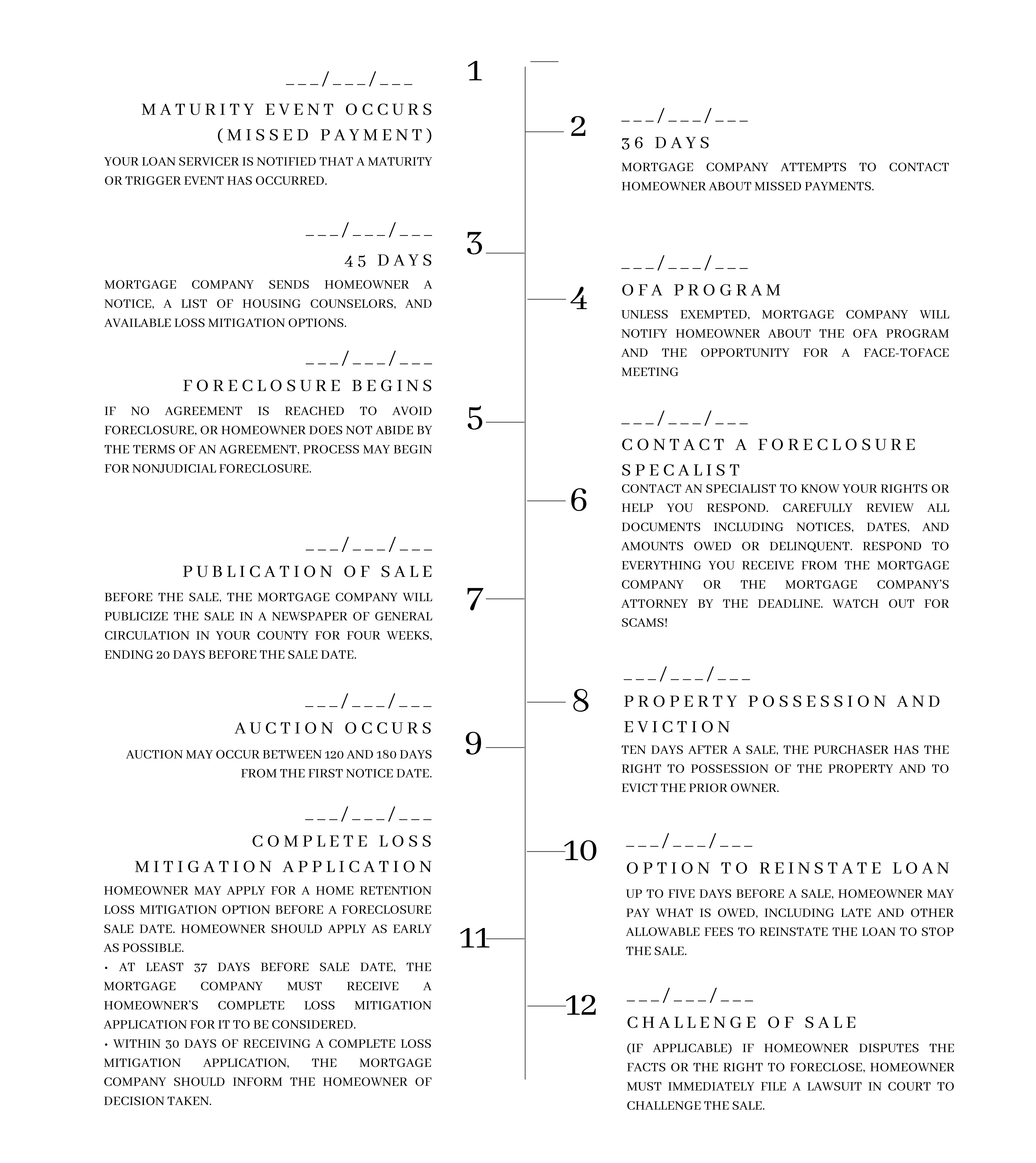

- Stage of foreclosure:

- The stage of foreclosure can impact the options available to you. If you’re in the early stages of foreclosure, you may have more time to negotiate with your lender and explore alternatives, such as loan modifications or refinancing. If you’re in the later stages of foreclosure, such as when an auction date has been set, your options may be more limited.

- Goals:

- Your goals can also impact your options. If your goal is to keep your home, you may explore options such as loan modifications or repayment plans. If your goal is to sell your home and avoid foreclosure, you may consider a short sale or deed in lieu of foreclosure. Understanding your goals can help you prioritize your options and make the best decision for your situation.

- Options you’ve already tried:

- If you’ve already tried negotiating with your lender or exploring alternatives, such as refinancing or loan modifications, you may need to explore other options or seek legal advice. An attorney can help you understand your legal rights and options and represent you in court if necessary.

- Limitations or challenges:

- Limitations or challenges, such as a low credit score or limited income, can also impact your options. In these cases, you may need to explore alternative sources of funding or consider selling your home to avoid foreclosure.

Overall, it’s important to work with your lender, seek professional advice, and explore all of your options to find the best solution for your situation.

Determine your barriers

Facing foreclosure can be a difficult and complex process, and some homeowners may encounter additional barriers that require additional resources and guidance. Some common barriers that homeowners may face when facing foreclosure include:

- Financial Issues: Homeowners facing foreclosure may struggle with a range of financial issues, including mounting debts, limited income, and difficulty finding employment. In this case, the homeowner may need assistance from financial counselors, credit counselors, or job placement services.

- Divorce: Going through a divorce can be emotionally and financially draining. It can also impact your ability to pay your mortgage, which can lead to foreclosure. You may need additional resources and guidance to help you navigate the legal and financial aspects of your divorce while also dealing with your mortgage.

- Criminal history: Having a criminal history can make it difficult to find employment or secure housing. This can make it challenging to keep up with your mortgage payments, which can result in foreclosure. You may need additional resources and guidance to help you find employment or housing that can enable you to keep up with your mortgage payments.

- Lack of employment: Losing your job can be a major financial setback that can impact your ability to pay your mortgage. You may need additional resources and guidance to help you find employment or explore other options for generating income to pay your mortgage.

- Medical Issues: If a homeowner is facing medical issues that make it difficult or impossible to work, they may struggle to keep up with mortgage payments. In this case, the homeowner may need to explore alternative sources of income or government assistance programs.

- Lack of Alternative Housing: If the homeowner does not have another place to live, they may be reluctant to leave their home, even if they are struggling to make mortgage payments. In this case, the homeowner may need assistance finding alternative housing or rental assistance programs.

- Language Barriers: Homeowners who do not speak English as their first language may have difficulty understanding the foreclosure process and their options for avoiding foreclosure. In this case, the homeowner may need assistance from a translator or a housing counselor who speaks their language.

- Legal Issues: Homeowners facing foreclosure may encounter legal issues, such as disputes over ownership of the property or problems with the mortgage servicer. In this case, the homeowner may need legal assistance to resolve these issues.

- Emotional Issues: Facing foreclosure can be a stressful and emotional experience. Homeowners may benefit from counseling or support services to help them cope with the stress and anxiety of the situation.

In general, anyone facing foreclosure may benefit from additional resources and guidance, regardless of their specific circumstances. These resources may include legal advice, financial counseling, and support services from community organizations. It’s important to seek out these resources as early as possible to increase your chances of avoiding foreclosure and finding a solution that works for you.